Top 10 Countries of Origin

Imports (2022‑2024) – The Philippines’ import basket remains dominated by East Asian suppliers, with China leading the pack at $29.8 bn in 2022, climbing to $34.5 bn in 2024 (+ 15 %). Indonesia follows, though its share fell from $13.9 bn to $11.3 bn, reflecting a modest contraction. Japan’s imports dropped sharply from $13.1 bn to $10.7 bn, while South Korea’s volume contracted then rebounded, ending at $10.0 bn in 2024. The United States, Thailand, Malaysia, Singapore, Vietnam, and Taiwan (China) round out the top ten, collectively accounting for roughly 70 % of total import value. The overall trend points to a growing reliance on Chinese goods, offset by a gradual diversification toward regional partners.

Top 10 Countries of Origin

Imports 2022 (Million US$)

Imports 2023 (Million US$)

Imports 2024 (Million US$)

Ch

29,796

30,934

34,491

Indonesia

13,936

12,284

11,291

Japan

13,086

10,921

10,671

South Korea

12,730

8,880

10,020

The United States

9,662

9,086

8,816

Thailand

7,656

8,187

7,796

Malaysia

6,681

6,235

6,239

Singapore

8,461

7,388

6,018

Vietnam

4,773

4,975

5,724

Taiwan, China

7,094

4,932

4,1

Top 10 Countries of Destination

Exports (2022‑2024) – The United States continues as the chief destination, albeit with a slight dip to $12.1 bn in 2024 after a low of $11.4 bn in 2023. Japan remains a strong market, holding steady around $10.3 bn. Hong Kong (China) and China itself are key Asian outlets, together contributing over $19 bn in 2024, though China’s share slipped to $9.4 bn from $10.9 bn in 2022. South Korea, Thailand, Singapore, the Netherlands, Taiwan (China), and Germany complete the top‑ten list, together representing roughly two‑thirds of export earnings. While traditional markets retain prominence, the data hint at a modest shift toward diversified Asian and European destinations.

Top 10 Countries of Destination

Exports 2022 (Million US$)

Exports 2023 (Million US$)

Exports 2023 (Million US$)

The United States

12,461

11,412

12,056

Japan

11,094

10,425

10,254

Hong Kong, China

10,480

8,773

9,600

China

10,966

10,648

9,423

South Korea

3,127

3,479

3,564

Thailand

3,374

2,930

2,954

Singapore

4,909

3,521

2,935

NetherLands

2,941

3,085

2,867

Taiwan, China

2,965

2,629

2,676

Germany

2,779

2,479

2,456

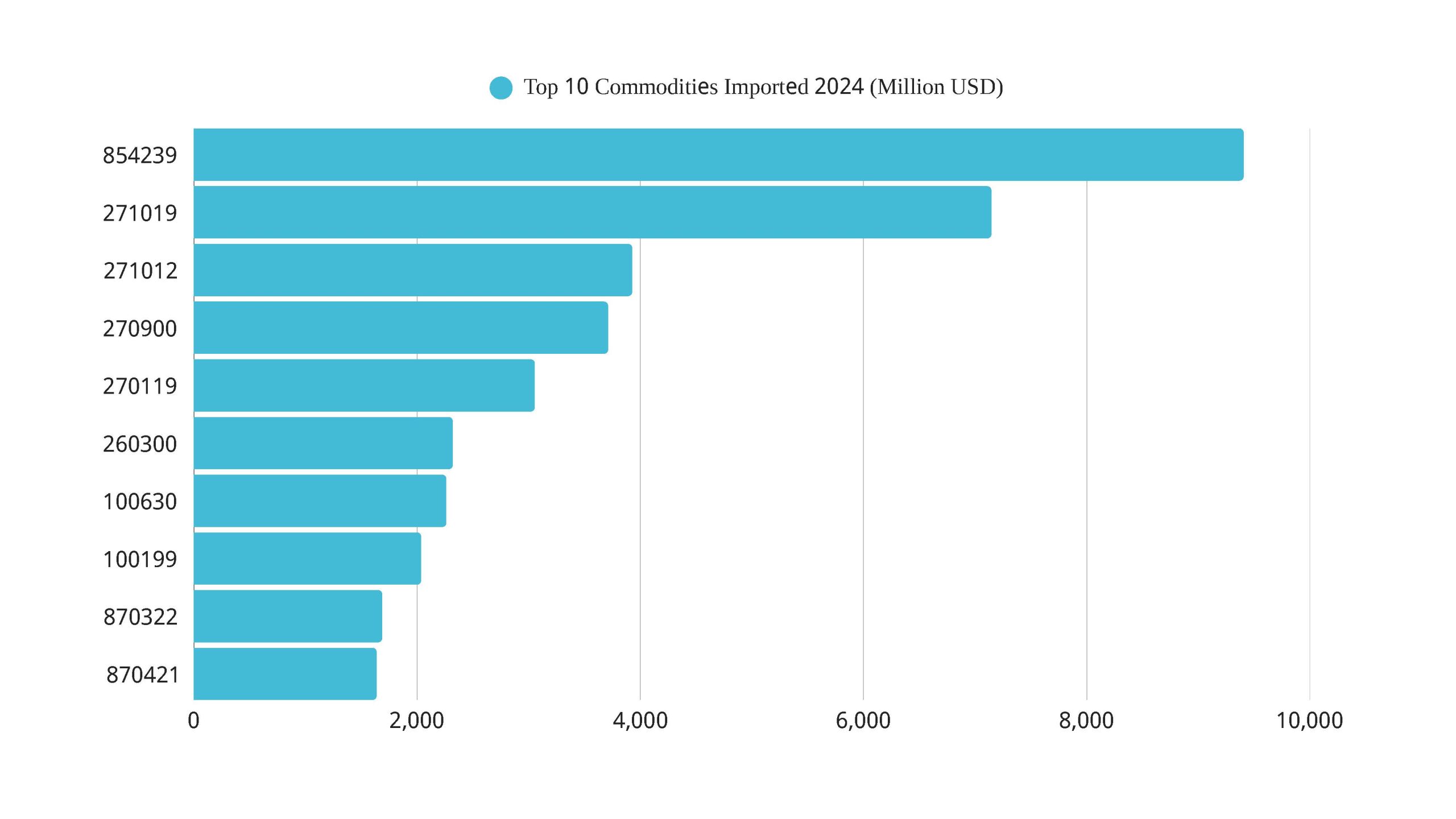

Top 10 Commodities Imported 2024

The distribution of import values points to a highly concentrated manufacturing‑supply chain. China’s dominant $34.5 bn share reflects massive inflows of electronic components, consumer appliances, and intermediate machinery parts. Indonesia ($11.3 bn) and Vietnam ($5.7 bn) supply primarily raw commodities—palm oil, rubber, and agricultural staples—that feed downstream processing. Japan ($10.7 bn) and South Korea ($10.0 bn) contribute high‑tech equipment, automotive parts, and precision instruments. The United States, Thailand, Malaysia, Singapore and Taiwan (China) together account for the remaining 30 % of imports, largely consisting of specialty chemicals, refined petroleum products, and niche electronic assemblies. Overall, the Philippines’ import basket is overwhelmingly oriented toward finished and semi‑finished manufactured goods from its East‑Asian neighbors, with a modest but essential flow of primary commodities from Southeast‑Asian producers.

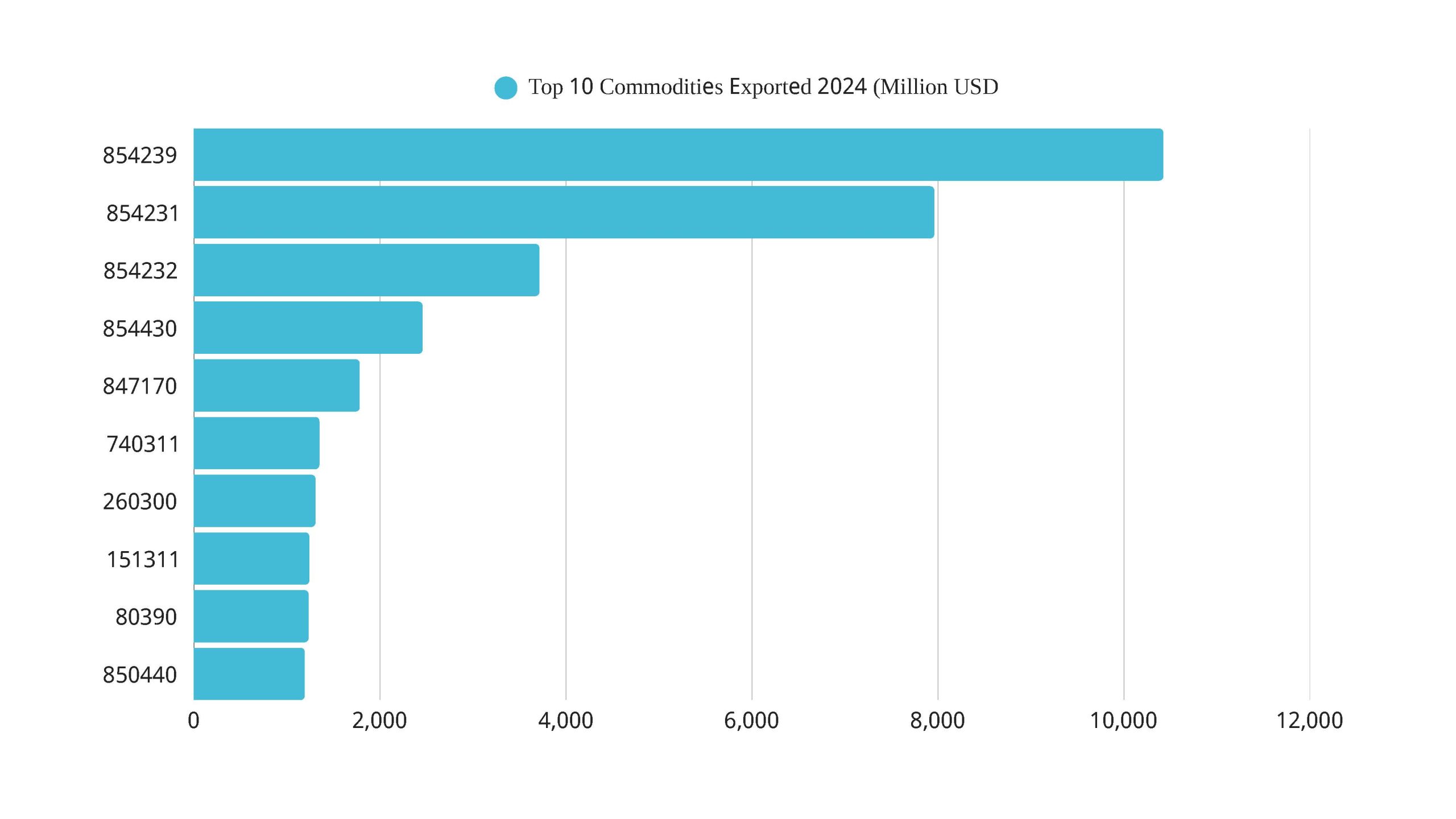

Top 10 Commodities Exported 2024

Export revenues are similarly focused on high‑value manufactured output. The United States ($12.1 bn) and Japan ($10.3 bn) absorb the bulk of Filipino electronics, semiconductor‑related hardware, and value‑added processed foods. Trade with Hong Kong and mainland China (~$19 bn combined) is driven by agricultural exports—seafood, tropical fruits, and coconut products—as well as re‑exported electronics. South Korea, Thailand, Singapore, the Netherlands, Taiwan (China) and Germany each receive between $2.5 bn and $3.5 bn, predominantly in electronic devices, computer peripherals, and select petrochemical derivatives. The export profile therefore underscores a dual strategy: supplying sophisticated electronic and tech‑manufactured goods to advanced economies while leveraging the country’s comparative advantage in agricultural and marine commodities for regional markets.